Heloc accelerated mortgage payoff calculator

Formally a mortgage loan or simply mortgage is a legal. Most homebuyers in America tend to obtain 30-year fixed-rate mortgagesAs of June 2020 the Urban Institute reports that 30-year fixed-rate loans account for 77 percent of new mortgages in the market.

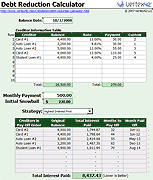

Heloc Mortgage Accelerator Spreadsheet Pay Off Mortgage Early Mortgage Loan Calculator Mortgage Loans

15 20 30 year Should I pay discount points for a lower interest rate.

. Click here for a 2022 Federal Tax Refund Estimator. Should I refinance my mortgage. Use this free debt calculator to determine the fastest and easiest way to pay down your debts.

Mortgage Payoff Calculator - by setting the desired payoff date. HELOC Tied directly to a mortgage. Should I convert to a bi-weekly payment schedule.

Comparing mortgage terms ie. 15 20 30 year Should I pay discount points for A lower interest rate. What are the tax savings generated by my mortgage.

One benefit of a HELOC is the long loan term. Federal Income Tax Calculator 2022 federal income tax calculator. Taxes are unavoidable and without planning the annual tax liability can be very uncertain.

Should I refinance my mortgage. Most HELOCs operate on a 30-year term with a draw period ranging from 10 to 15 years and a repayment period ranging from. Also you may check our HELOC calculator if you are specifically interested in a home equity line of credit.

Comparing mortgage terms ie. By using the mortgage calculator more than once and playing with the numbers you will get a better sense of how certain scenarios can raise or lower your payments shortening and lengthening the number of years before the mortgage will be paid off in full with interest can really be an eye opener. What are the tax savings generated by my mortgage.

An auto loan early payoff calculator like this one can help you figure out how much. What is a mortgage. The accelerated amount is slightly higher than half of the monthly payment.

Should I convert to a bi-weekly payment schedule. Compare a no-cost versus traditional mortgage. Comparing mortgage terms ie.

30-Year Mortgages and Extra Payments. Compare a no-cost vs. Should I rent or buy a home.

Comparing mortgage terms ie. Its popularity is due to low monthly payments and upfront costs. Should I rent or buy a home.

The 72t Early Distribution Illustration helps you explore your options for taking IRA distributions before you reach 59½ without incurring the IRS 10 early distribution penalty. Should I convert to a bi-weekly payment schedule. Comparing mortgage terms ie.

Use the following calculator to help determine your estimated tax liability along with your average and marginal tax rates. Should I rent or buy a home. Should I refinance my mortgage.

Loan amount - Either the remaining balance or in the case of a new loan give the original loan value. A shorter repayment period. 15 20 30 year Should I pay discount points for a lower interest rate.

Should I rent or buy a home. Should I refinance my home mortgage. Should I refinance my mortgage.

Pledge Share Account rate same as Regular Savings Share Account. Should I rent or buy a home. Use this additional payment calculator to determine the payment or loan amount for different payment frequencies.

100000 miles used to be considered a pretty good indication. Account for interest rates and break down payments in an easy to use amortization schedule. Use our free mortgage calculator to estimate your monthly mortgage payments.

This financial planning calculator will figure a loans regular monthly biweekly or weekly payment and total interest paid over the duration of the loan. Comparing mortgage terms ie. What are the tax savings generated by my mortgage.

Should I rent or buy a home. Compare a no-cost vs. 15 20 30 year Should I pay discount points for a lower interest rate.

The accelerated biweekly version will be higher at 59677. 15 20 30 year Should I pay discount points for a lower interest rate. How much home can I afford.

What are the tax savings generated by my mortgage. What are the tax savings generated by my mortgage. Should I refinance my mortgage.

Vehicles last longer as well as auto loans Cars SUVs Trucks last a lot longer than they used to. Compare a no-cost vs. Should I convert to a bi-weekly payment schedule.

Choose from calculators covering various aspects of mortgages auto loans investments student. Should I rent or buy a home. A 20-year loan is 240 monthly payments A 15-year loan is 180 monthly payments a 10-year loan is 120-monthly payments and 5 year loan is 60 monthly payments.

Bi-weekly mortgage payment - created for accelerated bi-weekly mortgage estimations. Compare a no-cost vs. Home Equity Loan Calculator HELOC Calculator.

Should I convert to a bi-weekly payment schedule. What are the tax savings generated by my mortgage. Should I refinance my mortgage.

Interest if you switched to making accelerated payments. Comparing mortgage terms ie. Should I refinance my mortgage.

Works like a credit card you only pay interest if you use it. Compare a no-cost vs. Should I rent or buy a home.

1 Minimum daily balances as stated are required to earn higher dividend rates and yields on these accounts. Should I convert to a bi-weekly payment schedule. Compare a no-cost vs.

2 IRA Accounts are insured separately from your Regular Savings Accounts up to 250000 by the National Credit Union Administration. In addition if you use an accelerated biweekly payment plan you can remove almost 5 years off a 30-year mortgage. 15 20 30 year Should I pay discount points for a lower interest rate.

Type of acceleration - The mortgage acceleration calculator offers three ways to calculate the result. 15 20 30 year Should I pay discount points for a lower interest rate. Analyze Pre-Retirement IRA Distribution Options With Our 72t Calculator 72t early distribution analysis.

What are the tax savings generated by my mortgage. Should I convert to a bi-weekly payment schedule. Compare a no-cost vs.

In addition to the standard mortgage calculator this page lets you access more than 100 other financial calculators covering a broad variety of situations. Make payments weekly biweekly semimonthly monthly bimonthly quarterly or. A mortgage payoff calculator can help you.

Most home loans are structred as 30-year loans which is 360 monthy payments. To run the mortgage acceleration calculator you need to specify the following parameters for your mortgage loans. Comparing mortgage terms ie.

For instance if your monthly payment is 119354 its biweekly counterpart is 55086. 3 The Annual Percentage Yield assumes that dividends. 15 20 30 year Should I pay discount points for a lower interest rate.

Should I convert to a bi-weekly payment schedule. Are you starting biweekly payments in a middle of a loan schedule. Adding Subtracting Time.

Truth In Equity Heloc Payment Payoff Calculator

Mortgage Payoff Calculator With Line Of Credit

Mortgage Payoff Calculator With Line Of Credit

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Heloc Calculator How To Get To Your Payoff Date Youtube

Truth In Equity Heloc Payment Payoff Calculator

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Early Mortgage Payoff Calculator Heloc Strategy Youtube

Mortgage Acceleration Calculator

Early Mortgage Payoff Calculator Heloc Strategy Youtube

Home Equity Line Of Credit Heloc Rocket Mortgage

![]()

Mortgage Payoff Calculator With Line Of Credit

Home Equity Line Of Credit Heloc Rocket Mortgage

Mortgage Payoff Calculator Accelerated Mortgage Payment Calculator With Extra Payments

Early Mortgage Payoff Calculator 2022 Payoff Your Mortgage Early Casaplorer

Mortgage Payoff Calculator With Line Of Credit