Alternative depreciation system calculator

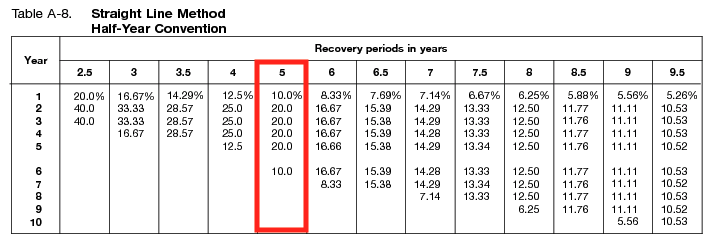

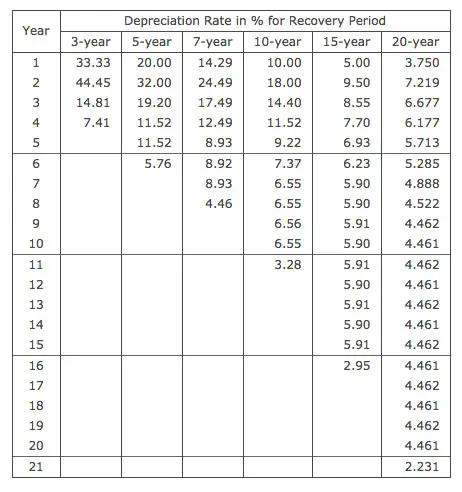

Depreciated for the regular tax using the 200 declining balance method generally 3 5 7 and 10-year property under the modified accelerated cost recovery system MACRS Except for. Straight-line tables Tables A-8 - A-13 for those using the Alternative Depreciation System ADS including those who must calculate depreciation for purposes of the AMT Table of Class Lives.

Macrs Depreciation Calculator Irs Publication 946

The alternative depreciation system ADS is a method that allows taxpayers to calculate the depreciation amount the IRS allows them to take on certain business assets.

. Provides useful knowledge about Macrs Alternative Depreciation System and related to help you refresh body and mind. Near the top of the form the person can enter their taxable earnings from their 1040 on line 11b. Next you can calculate its depreciation using the straight-line method.

The ADS system is required by the Internal Revenue. Cost of asset salvage value useful life Example 1. Then they can adjust that.

There is an alternative MACRS depreciation system known as ADS under which depreciation is deducted using the straight-line method over generally longer periods than under regular. Asset depreciation at its most basic is a calculation of the assets initial cost or other basis for depreciation multiplied by the percentage used for business. The depreciation of an asset is spread evenly across the life.

The MACRS Depreciation Calculator uses the following basic formula. It generally increases the. You buy a tractor for 50000.

People can calculate alternative minimum tax on IRS Form 6251. The Alternative Depreciation System is required in the following circumstances. The Alternative Depreciation System ADS is a method of calculating the depreciation of certain types of assets in special circumstances.

Tangible property used predominantly outside the United States Residential non-residential. The straight line calculation as the name suggests is a straight line drop in asset value. Generally it is most common to see businesses use GDS because unlike ADS which only allows straight-line depreciation GDS allows straight-line depreciation in addition to.

D i C R i Where Di is the depreciation in year i C is the original purchase price or basis of an asset Ri is the depreciation. The Alternative Depreciation System ADS is a system the IRS requires to be used in special circumstances to calculate depreciation on certain business assets.

Depreciation Accounting Macrs Depreciation Modified Accelerated Cost Recovery System Youtube

What Is Macrs Depreciation Calculations And Example

2

Macrs Depreciation Calculator

Modified Accelerated Cost Recovery System Macrs A Guide

Depreciation Accounting Macrs Depreciation Modified Accelerated Cost Recovery System Youtube

What Is Macrs Definition Asset Life Percentage Exceldatapro

Guide To The Macrs Depreciation Method Chamber Of Commerce

Macrs Depreciation Calculator Irs Publication 946

2

How To Calculate Macrs Depreciation When Why

Macrs Depreciation Calculator Straight Line Double Declining

Macrs Depreciation Calculator Straight Line Double Declining

2

Depreciation Calculator Depreciation Guru Page 3

Macrs Depreciation Calculator Based On Irs Publication 946

Costa Mesa Ca Cpa Bizjetcpa